What is SASSA and Why are Income Limits Important?

The South African Social Security Agency (SASSA) is the government agency responsible for distributing social grants to vulnerable citizens. These grants are a critical part of the social support system, providing financial relief to millions of people, from older persons to children. But since the funds are limited and need to be allocated fairly, SASSA uses an income assessment called a means test. This test evaluates your personal income, and in some cases, your household income, to determine if you meet the financial criteria for a specific grant.

Understanding this test is the first step to a successful application. Not declaring your full income can lead to penalties, including a suspension of your grant, so honesty is key.

Understanding the Means Test

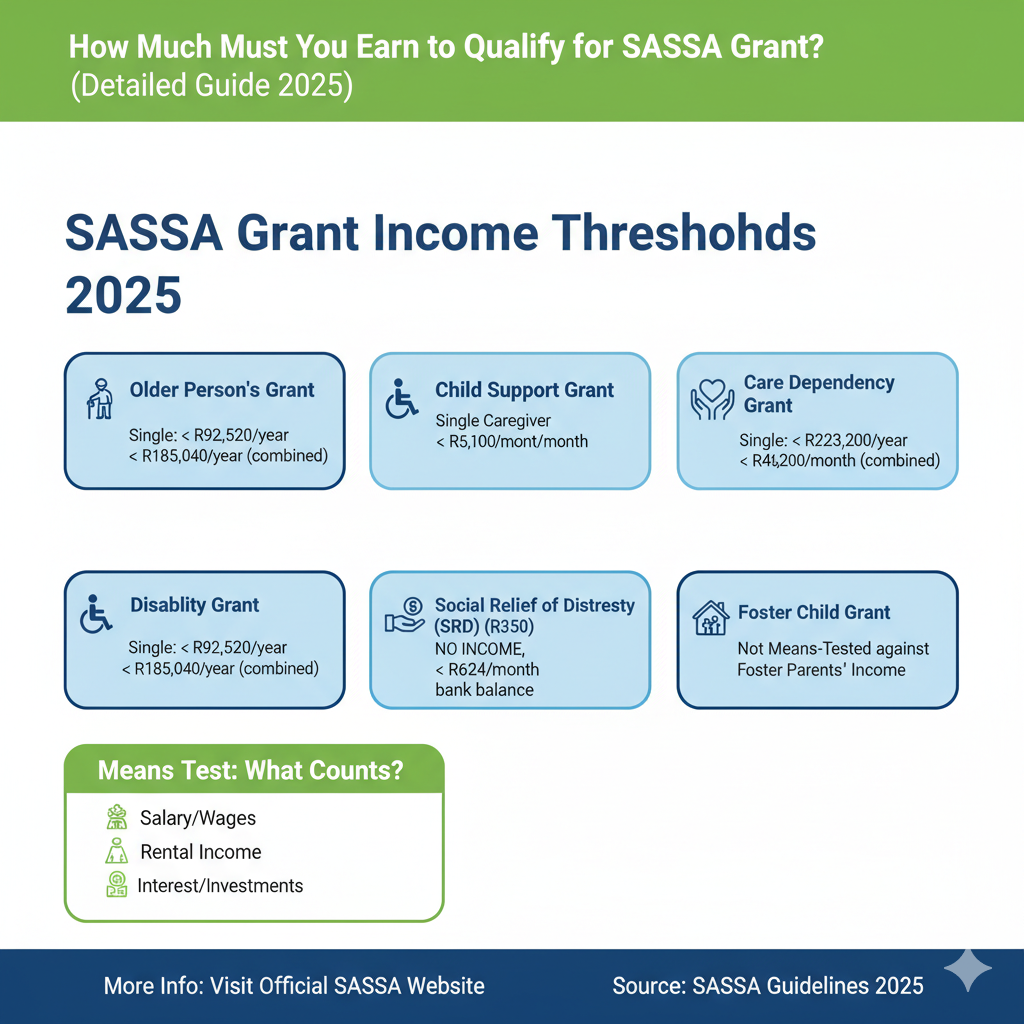

A means test is a method used by SASSA to calculate your financial status. It’s not just about your monthly salary—it considers all forms of income. This includes:

- Salaries or wages from a job.

- Rental income from property you own.

- Pensions from previous employment.

- Interest earned on savings and investments.

The means test is designed to be a comprehensive check of your financial situation, which is why it’s so important to have all your documents ready and be transparent about your earnings.

Income Thresholds for Different SASSA Grants (2025)

The income limits for each grant are different and are subject to change, so it’s vital to have the most up-to-date information. Here are the 2025 income thresholds for the main grant types:

1. Older Person’s Grant (Old Age Pension)

- Single person: Your annual income must not exceed R92,520 (or R7,710 per month). Additionally, your assets (like property or savings) must be valued at less than R1,317,600.

- Married couple: Your combined annual income must be below R185,040 (or R15,420 per month). Your combined assets must be valued at less than R2,635,200.

2. Disability Grant

- Single person: The annual income threshold is the same as the Older Person’s Grant, at R92,520. Your assets must be worth less than R1,317,600.

- Married couple: The combined annual income limit is R185,040, with combined assets valued at less than R2,635,200.

To qualify, you must also have a medical assessment report from a state-appointed doctor confirming your disability.

3. Child Support Grant

This grant has different rules for single and married caregivers. The income limits are based on your monthly income:

- Single caregiver: Your monthly income must be below R5,100.

- Married couple: Your combined monthly income must be below R10,200.

4. Social Relief of Distress (SRD) Grant (R350)

This is a temporary grant for those with no income or support. The income test for the SRD grant is stricter. Your bank account must not show an income of more than R624 per month. This is a critical point that many people miss, as any money received, even from family, can count against you.

5. Care Dependency Grant

This grant is for caregivers of children with severe disabilities. The income limits are based on your annual income:

- Single person: Your annual income must be below R223,200.

- Married couple: Your combined annual income must be below R446,400.

6. Foster Child Grant

The Foster Child Grant is unique because it is generally not means-tested against the foster parent’s income. The grant is intended to support the child, not the caregiver, and is based on a court order.

Step-by-Step Guide to Calculating Your Income

To avoid mistakes, follow these steps to accurately calculate your income:

- Gather all documents: Collect payslips, bank statements from the last three months, pension slips, and any other proof of income.

- Add it all up: Calculate your total income from all sources (salary, rental income, side jobs, etc.).

- Check against the threshold: Compare your total monthly or annual income to the specific threshold for the grant you’re applying for.

What Happens If Your Income Exceeds SASSA Limits?

If your income increases and you no longer meet the eligibility criteria, you have a responsibility to inform SASSA. Not doing so can be considered fraud. If your grant is suspended, you can appeal the decision. SASSA will provide a letter explaining the reasons for the suspension, and you can submit a formal appeal within 90 days of receiving the notification.

How to Apply for SASSA Grants

The application process requires careful attention to detail. Here’s what you need:

- Your 13-digit, bar-coded South African ID.

- Proof of residence.

- Proof of all income and assets.

- Bank statements from the last three months.

- A medical report (for Disability and Care Dependency Grants).

- For the Older Person’s Grant, proof of marital status and a discharge certificate if you were previously employed.

You can apply at your nearest SASSA office.

Debunking Common Myths and Misconceptions

- Myth: “My pension or rental income won’t be counted.”

- Fact: All forms of income, including pensions and rental income, are considered in the means test.

- Myth: “SASSA audits my bank account every month.”

- Fact: SASSA may perform regular reviews of your income and circumstances to ensure you still qualify.

Expert Advice on Qualifying for SASSA Grants

Financial experts and SASSA officials often provide advice to applicants:

- Be prepared: Have all your documents ready before you apply. This speeds up the process and reduces the risk of rejection.

- Understand the means test: Know exactly which income sources are counted and how they are calculated.

- Consult with SASSA officials: If you’re unsure about any part of the process, visit a local office or call the helpline.

Statistical Insights & Data (2025)

The latest data from SASSA shows a growing need for grants, with the number of beneficiaries rising across all categories. The recent increase in grant amounts in 2025, confirmed by the Minister of Finance, is aimed at providing greater financial relief to beneficiaries. These adjustments often come with a review of the income thresholds to ensure the grants remain targeted at the most vulnerable.

Printable Checklist: Income Eligibility & Application Process

To make things easy, here’s a quick-reference checklist you can use:

- Required Documents:

- ID Book

- Bank Statements (last 3 months)

- Payslips/Income Proof

- Proof of Residence

- Income Check:

- Is your annual income below the specific threshold for your grant?

- If married, is your combined annual income below the threshold?

SASSA Office Branch Locator (Major Cities)

For personal assistance, you can visit a SASSA office in major cities.

- Johannesburg: 28 Harrison Street, Johannesburg.

- Cape Town: Golden Acre, Adderley Street, Cape Town.

- Durban: 1 Bank Street, Pietermaritzburg.

- Pretoria: 501 Prodinsa Building, Cnr Beatrix and Pretorius Street, Pretoria.

Conclusion

Navigating the SASSA grant system doesn’t have to be overwhelming. By understanding the specific income thresholds, gathering all the required documents, and being honest about your financial situation, you can significantly improve your chances of a successful application. Remember, these grants are there to provide essential support, and being prepared is the best way to ensure you receive the help you need.