SASSA Card Declined: Troubleshooting and Solutions (2025 Full Guide)

When a Declined SASSA Card Stops Everything

Imagine standing in line at the ATM on payday, finally ready to withdraw your SASSA grant—only to see the message “Transaction Declined.” For millions of South Africans, this frustrating moment can mean the difference between buying groceries or going home empty-handed.

The SASSA card, issued by Postbank, is a vital link between social grants and the people who rely on them every month. It provides quick, secure access to the SRD R370 Grant, Old Age Pension, Disability Grant, and Child Support Grant, among others. But in 2025, with ongoing Postbank system migrations and the transition to the new Black Card, many beneficiaries have reported declined transactions, blocked cards, or delayed payments.

If your SASSA card has been declined, there’s no need to panic. In this comprehensive guide, we’ll walk you through why your card might not be working, how to troubleshoot and fix the issue, and what steps to take if your card is expired, blocked, or lost. You’ll also find important fraud alerts, renewal advice, and contact details to help you resolve any issue quickly.

Understanding Why the SASSA Card Matters

For many beneficiaries, the SASSA Gold or Black Card is more than just a payment tool—it’s a lifeline. It ensures access to essential items like food, transport, and medication, helping vulnerable individuals maintain dignity and stability.

The SASSA card system is managed by Postbank, which handles grant disbursements for millions of South Africans each month. Funds are deposited directly into a Postbank-managed account, accessible through ATMs, retail stores like Shoprite, Boxer, Pick n Pay, and Usave, or point-of-sale (POS) terminals nationwide.

But despite this efficiency, errors do occur. And when they do, beneficiaries are often left in confusion. Understanding the causes behind SASSA card declines—and the correct way to fix them—can save you hours of frustration and unnecessary trips to the bank or SASSA office.

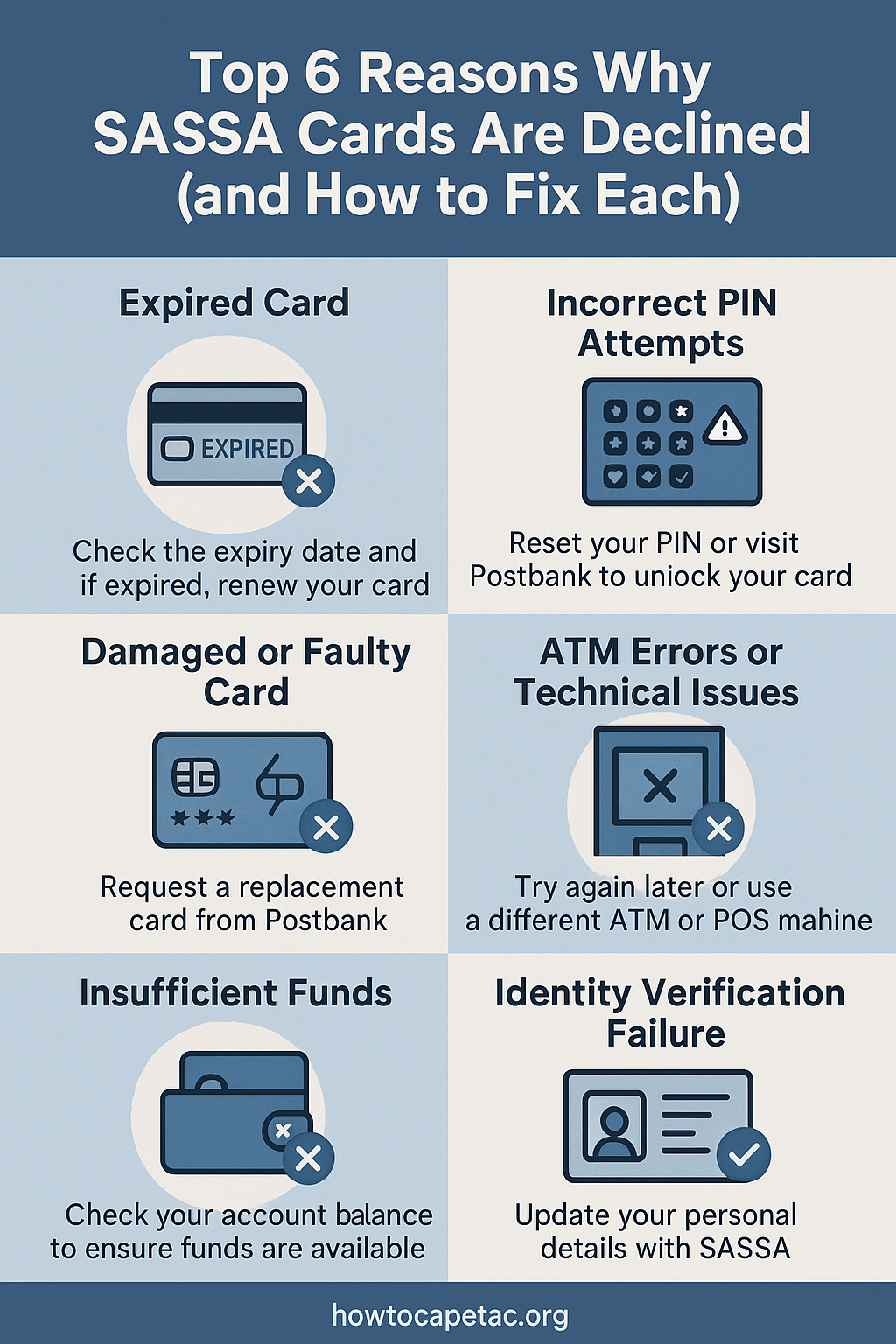

Why Is My SASSA Card Declined?

A declined SASSA card doesn’t necessarily mean you’ve done something wrong. It’s often the result of technical or administrative issues. Let’s explore the most common causes:

1. Expired SASSA Card

Every SASSA card has a printed expiry date. Once it expires, it automatically stops working, preventing any ATM withdrawals or purchases.

In 2025, many Gold Cards issued before 2021 are now expiring, prompting Postbank to roll out a nationwide Black Card replacement campaign. If you’re still using an older Gold Card, your transaction may fail simply because your card has reached its expiry date.

2. Incorrect PIN Attempts

If you enter the wrong PIN three times or more, your card will automatically be locked. This security feature prevents unauthorized use but also means you can’t access your funds until the PIN is reset at a Postbank branch.

3. Damaged or Faulty Card

Sometimes the physical card itself is to blame. A scratched chip, bent corner, or demagnetized strip can prevent ATMs and POS machines from reading your card correctly. Even minor damage can trigger a “card declined” message.

4. ATM or POS System Errors

Not all declines are your fault. ATMs occasionally go offline or lose connection to the Postbank network. During these moments, even perfectly valid cards can be declined. Many beneficiaries in rural areas experience this when certain machines are temporarily down or overloaded.

5. Insufficient Funds

It might sound simple, but sometimes the card declines because your payment hasn’t yet been deposited or you’ve already withdrawn the full grant amount. Always confirm your payment date before withdrawing.

6. Identity Verification Issues

Your card is linked to your SASSA profile and identity details. If SASSA cannot verify your information with Home Affairs—for example, if your ID number or name is mismatched—the system may temporarily freeze your card for verification.

7. Fraud or Suspicious Activity

Postbank uses automatic security checks to detect irregular transactions. If the system flags suspicious withdrawals or rapid card usage in multiple locations, it can temporarily block your card to protect your funds.

How to Fix a Declined SASSA Card

A declined transaction can be resolved in most cases within a few hours or days, depending on the cause. Follow these troubleshooting steps carefully.

Step 1: Check the Expiry Date

Look at the expiry date printed on the front of your card. If the date has passed, your card has expired, and you’ll need to replace it. Visit your nearest Postbank branch or SASSA office with your ID to renew or switch to the new Postbank Black Card.

Step 2: Check Your Balance

Before assuming there’s a system problem, confirm your account balance. You can:

- Check at any ATM.

- Dial

*120*3210#on your phone. - Use WhatsApp: message “Hi” to 060 012 3456 and follow the prompts.

If no funds have been deposited yet, your withdrawal will be declined until payment is released.

Step 3: Try a Different ATM or Store

Technical glitches happen. If your transaction fails at one ATM, try another location—especially a Postbank or Shoprite ATM. Sometimes the issue lies in a temporary network failure rather than your account.

Step 4: Reset Your PIN

If your card is locked after multiple incorrect PIN attempts, you’ll need to reset it. Visit a Postbank branch with your ID and card. The staff will unlock your account and let you choose a new 4-digit PIN. The process takes about 10–30 minutes.

Step 5: Update Your Personal Information

Ensure your details are correct in the SASSA system. Mismatched ID numbers or old addresses can cause delays. You can update your personal info at any SASSA office or through the SASSA online portal.

Step 6: Contact SASSA or Postbank for Help

If none of the above works, it’s time to call for assistance.

- SASSA Toll-Free: 0800 60 10 11

- Postbank Card Services: 0800 53 54 55

Have your ID number and card ready. Explain the issue clearly; support staff can check your account status, confirm if your card is blocked, and help restore access.

Postbank Black Card Migration Issues in 2025

Since early 2025, Postbank has been replacing the old Gold Cards with Black Cards featuring enhanced security and longer expiry dates. While this upgrade improves long-term stability, it has caused temporary disruptions for some beneficiaries.

If your Gold Card has been replaced with a Black Card, you might experience:

- Funds not showing in your new account immediately.

- Card declining due to unactivated PIN.

- System mismatch between your old and new card numbers.

How to Fix Postbank Migration Decline Issues

- Confirm Migration: Visit your nearest Postbank branch to verify that your profile and ID number are correctly linked to your new Black Card.

- Activate the Card: Insert the new card at a Postbank ATM and follow the activation steps.

- Wait 24–48 Hours: It can take a day or two for funds to transfer after migration.

- Contact Postbank: If the problem persists beyond two days, call 0800 53 54 55 to log a ticket.

Blocked or Locked SASSA Card: What You Should Do

A locked SASSA card usually happens after several failed PIN attempts or suspected fraud. The good news? It’s easily fixable.

Visit a Postbank branch with your ID book/card and SASSA card. Ask to reset or unlock your PIN. Once your identity is verified through biometrics, the card will be reactivated, and you can set a new PIN immediately.

If the card was blocked due to fraud suspicion, Postbank might hold it for investigation. Keep your ID handy, and follow up regularly until the hold is lifted.

Card Lost or Stolen: Reporting and Replacement

If your SASSA card is lost or stolen, report it immediately to prevent fraudulent withdrawals.

- Call Postbank or SASSA:

- SASSA Helpline: 0800 60 10 11

- Postbank: 0800 53 54 55

- Request a Card Block: The representative will block the old card to prevent further transactions.

- Apply for a Replacement: Visit a Postbank branch with your ID and proof of address to get a new card.

- Collect & Activate: Your new card will be issued on the spot or within a few days, depending on branch availability.

Common Reasons for Card Declines and How to Prevent Them

Declines often repeat because the underlying issues aren’t addressed. Here are the most common culprits and how to prevent them.

Incorrect Personal Details

Ensure your SASSA profile matches your Home Affairs records. Even a small spelling mistake can cause verification failures and payment delays. Always update your personal details when renewing your card or changing your address.

Technical Glitches

Avoid ATMs or POS devices that appear slow or unresponsive. If you notice the screen freezing or showing error messages, cancel your transaction immediately and try elsewhere.

Unreported Changes

Whenever you change your phone number, banking details, or address, notify SASSA. Failure to update can lead to declined transactions or suspended grants.

Fraud Holds

If you notice repeated declines after successful withdrawals, call Postbank. It could be a fraud flag placed on your account for unusual activity. Reporting early prevents full account suspension.

How Long It Takes to Unblock a SASSA Card

The time it takes to unblock a SASSA card depends on the reason for the block:

- Incorrect PIN: 10–30 minutes at a Postbank branch.

- Expired Card Renewal: Instant replacement if stock is available.

- Fraud Hold: 3–7 working days while verification is completed.

Always keep your SMS notifications enabled so that Postbank can alert you when your card becomes active again.

Preventing Future SASSA Card Declines

A bit of preparation can save you a lot of headaches. Follow these practical habits to keep your SASSA card working smoothly:

- Renew Early: Don’t wait until your card expires. Visit Postbank months before expiry for a smooth transition.

- Keep Information Updated: If your phone number or address changes, update it with SASSA.

- Check Balances Before Withdrawing: Always confirm that your grant has been paid before heading to the ATM.

- Use Secure Machines: Choose ATMs in well-lit, reputable locations—preferably Postbank or Shoprite machines.

- Avoid Card Damage: Keep your card away from magnets, sunlight, and bending. Store it safely in a wallet.

- Monitor Your Transactions: Keep track of every withdrawal to spot unusual activity early.

Fraud & Scam Alert: Protect Your Card in 2025

Fraudsters have become smarter—and 2025 has seen a rise in scams targeting SASSA beneficiaries. Many victims receive SMSes or WhatsApp messages pretending to be from SASSA or Postbank, offering “fast renewals” or asking for PINs.

How to Spot a Fake Message

- The sender uses a random number instead of the official “SASSA” label.

- You’re asked to click a suspicious link or pay a “renewal fee.”

- The message promises faster grant approval or back-pay.

SASSA never asks for personal details, PINs, or payments.

If you suspect a scam, immediately report it to:

- fraud@sassa.gov.za

- 0800 60 10 11

SASSA and Postbank Contact Information

If you’ve tried all troubleshooting steps and your card still doesn’t work, contact the relevant support line:

Service | Contact | Hours | Purpose |

|---|---|---|---|

SASSA Helpline | 0800 60 10 11 | Mon–Fri, 8 am–4 pm | General grant queries |

Postbank Card Services | 0800 53 54 55 | Daily, 7 am–7 pm | Card and ATM problems |

WhatsApp Support | 082 046 8553 | 24/7 | Card & status inquiries |

Email Support | — | Documented assistance | |

In-Person | Nearest SASSA or Postbank branch | Office hours | Renewal, replacement, verification |

Keep these numbers saved on your phone for easy access. Most issues can be resolved remotely without visiting an office.

FAQs

Conclusion: Stay Informed, Stay Empowered

A declined SASSA card can cause anxiety, but it doesn’t mean you’ve lost your money. Most problems are temporary—caused by expired cards, technical glitches, or routine security measures. With the Postbank Black Card rollout in 2025, card stability and security are improving, ensuring smoother access for all beneficiaries.

By following the steps in this guide, keeping your information updated, and staying alert for scams, you can make sure your SASSA payments continue without interruption.

If you ever feel stuck, don’t wait—call SASSA or Postbank, visit a branch, or check your balance online. The sooner you act, the sooner your grant access will be restored.

Your SASSA card is your gateway to financial support—keep it secure, renewed, and ready to use whenever you need it.