SASSA Gold Card 2025: Renewal, Replacement & Postbank Black Card Transition

Why the 2025 Gold Card Update Matters

For more than a decade, the SASSA Gold Card has been the trusted way millions of South Africans receive their social grants. Issued through Postbank, the card lets beneficiaries withdraw cash, shop, and manage payments securely—without needing a formal bank account.

In 2025, SASSA and Postbank announced a major replacement drive: the Gold Card system is being phased out and upgraded to the Postbank Black Card. This change ensures stronger security, chip-and-PIN protection, and uninterrupted access to grants after card expiry.

This complete 2025 guide explains:

- Who must renew or replace the Gold Card

- How to switch to the new Black Card through Postbank

- How to activate, use, and check balances

- What to do if your card is lost, stolen, or expired

- Scam alerts & official contact channels

What Is the SASSA Gold Card?

The SASSA Gold Card is a prepaid debit card linked to a beneficiary’s grant account. It is issued through Postbank, a division of the South African Post Office.

Unlike normal bank cards, it is tailor-made for beneficiaries of:

- Older Persons Grant

- Disability Grant

- Child Support Grant

- Foster Child Grant

- Care Dependency Grant

- War Veterans Grant

- Social Relief of Distress (SRD R370)

Key Features

- Works at ATMs, retail stores, and POS terminals

- Includes chip & PIN security

- No monthly bank charges for grant withdrawals

- Allows cashless shopping and bill payments

Difference Between the Gold Card and the New Postbank Black Card

|

Feature |

Gold Card |

Postbank Black Card (2025) |

|---|---|---|

|

Issuer |

Postbank (SAPO) |

Postbank Ltd (Independent) |

|

Technology |

Standard Chip |

Enhanced EMV chip + anti-fraud PIN layer |

|

Expiry |

Phasing out 2025 |

Valid 5 years (renewal cycle 2030) |

|

Colour |

Gold |

Matte Black with Postbank logo |

|

Withdrawal Network |

ATMs & Retail Stores |

Same + CashSend & Cardless options |

|

Purpose |

Legacy grant payments |

Modernised secure payment platform |

Tip: Both cards remain valid until your printed expiry date, but Postbank urges beneficiaries to replace early to avoid interruptions.

Why the Switch in 2025?

SASSA’s partnership with Postbank aims to improve:

- Security: Old cards are vulnerable to skimming and fraud.

- Efficiency: New cards support modern ATMs and retail systems.

- Compliance: Meets South African Reserve Bank security standards.

- Continuity: Ensures grant payments continue without delays after expiry.

Eligibility for a SASSA Gold or Black Card

To qualify, you must:

- Be a South African citizen, permanent resident, or registered refugee/asylum seeker.

- Be an approved SASSA grant beneficiary.

- Provide valid ID (book or card) and proof of address.

- Have no existing Postbank Black Card in use (for renewal cases).

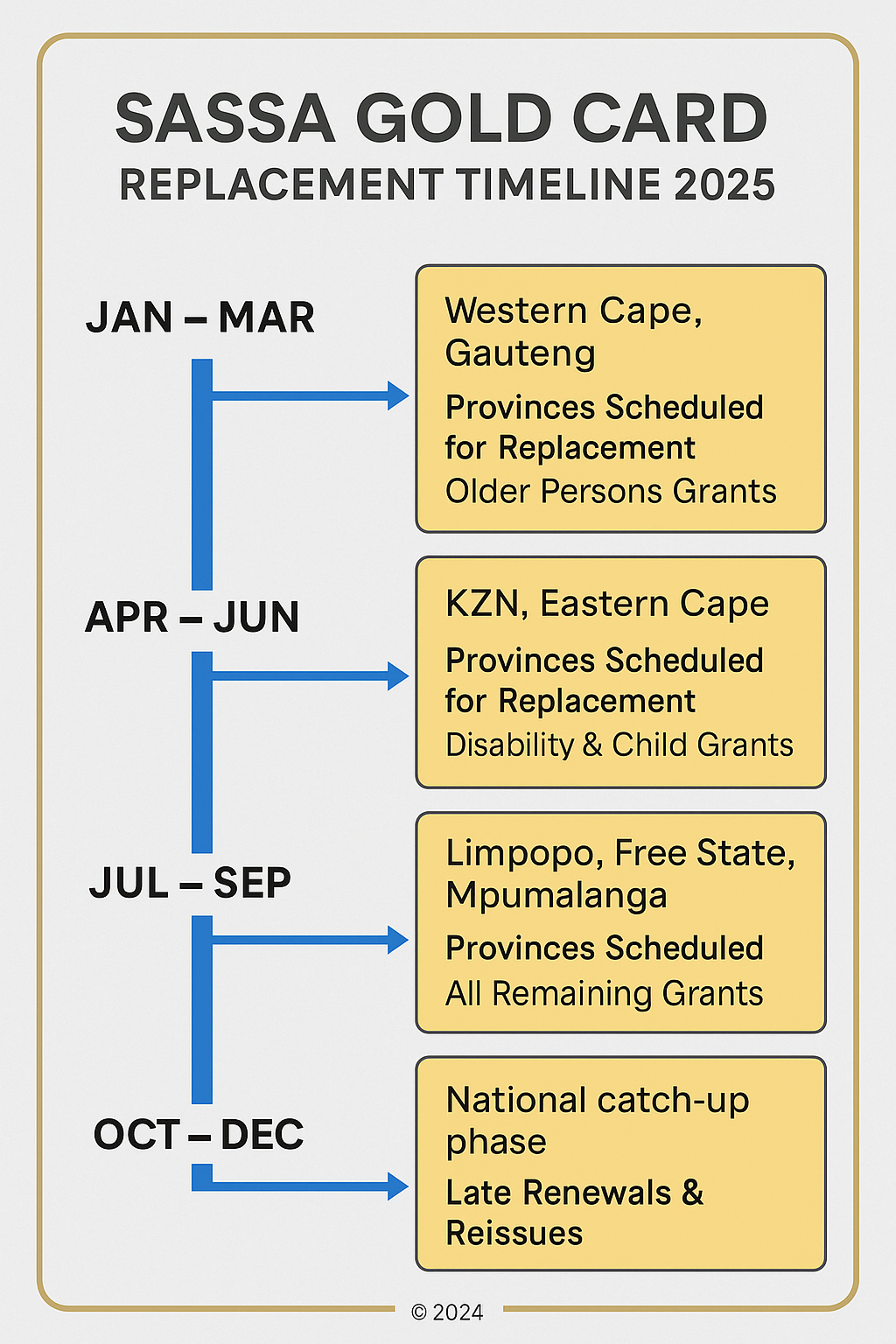

SASSA Gold Card Deadline 2025 – Replacement Timeline

|

Month (2025) |

Provinces Scheduled for Replacement |

Focus Groups |

|---|---|---|

|

Jan – Mar |

Western Cape, Gauteng |

Older Persons Grants |

|

Apr – Jun |

KZN, Eastern Cape |

Disability & Child Grants |

|

Jul – Sep |

Limpopo, Free State, Mpumalanga |

All remaining grants |

|

Oct – Dec |

National catch-up phase |

Late renewals & reissues |

Deadline: Postbank confirms that all Gold Cards expire by 31 December 2025. After that date, only the Black Card will be valid for grant payments.

How to Replace Your SASSA Gold Card with a Postbank Black Card

Step 1: Visit Your Nearest Postbank Branch

Bring your ID and old Gold Card. Branches are open nationwide with dedicated SASSA service queues.

Step 2: Complete the Replacement Form

Staff will capture your details and verify your grant type and contact information.

Step 3: Biometric Verification

Your fingerprints and ID are scanned to confirm identity and prevent duplicate accounts.

Step 4: Card Issuance & Activation

Receive your Black Card on the spot. Set a PIN before leaving the branch.

Step 5: First Withdrawal or Balance Check

Test your card at an ATM or retail till to ensure funds are accessible.

How to Apply for a New Gold/Black Card (if Lost or Expired)

If you never had a card or it’s damaged:

- Go to any SASSA office or Postbank branch.

- Bring your ID, proof of address, and SASSA approval letter.

- Fill out Form 1 (Application for Grant Card Replacement).

- Wait for SMS notification (usually within 48 hours).

- Collect and activate your card.

Processing is free for first-time cards and R26–R30 for replacements.

Card Activation & PIN Setup

- Insert card into Postbank ATM.

- Choose “Activate Card” → enter ID number.

- Set a 4-digit PIN of your choice.

- Confirm PIN twice and print receipt.

Safety Tip: Never share your PIN with anyone—including people posing as SASSA officials.

How to Check Your SASSA Balance (3 Methods)

- ATM Check: Insert card → Balance Inquiry → Print Slip.

- USSD: Dial

*120*3210#and follow prompts. - WhatsApp SASSA: Save 060 012 3456 → send “Hi” → choose “Check Balance.”

Tip: You can also link your Postbank account to the Postbank App for digital balance tracking.

Common Problems and Fixes

1. Card Not Working

- Check expiry date and card damage.

- Reset blocked PIN via Postbank branch.

- Contact helpline 0800 53 54 55.

2. ATM Decline

- Ensure ATM supports Postbank network.

- Verify sufficient balance.

- Try a different ATM or retail store.

3. Expired Card

- Visit Postbank before deadline.

- Bring old card and ID for free replacement.

4. Lost or Stolen Card

- Call Postbank immediately to block it.

- Report to nearest SASSA office for replacement.

- Bring affidavit if stolen.

Scam & Fraud Alerts

Beware of Fake SMS or Emails

Fraudsters pose as SASSA agents offering “fast card renewals.” SASSA never asks for PINs or charges fees for replacements.

How to Stay Safe

- Only visit official Postbank/SASSA branches.

- Verify SMS originating from SASSA short code “SASSA”.

- Never click links sent via WhatsApp from unknown numbers.

- Report scams to fraud@sassa.gov.za or 0800 60 10 11.

Managing Your SASSA Card Effectively

- Check balances regularly.

- Keep contact details updated.

- Avoid third-party cash withdrawal fees by using Postbank ATMs.

- Store receipts for dispute proof.

Contact Information

- Postbank Customer Care: 0800 53 54 55

- SASSA National Helpline: 0800 60 10 11

- Email: grantenquiries@sassa.gov.za

- Visit nearest SASSA regional office for urgent help.

Official 2025 Announcements Summary

- Jan 2025: Postbank launches nationwide Black Card rollout.

- Mar 2025: Gold Card holders receive SMS replacement alerts.

- Jul 2025: Free replacement extended to rural areas.

- Oct 2025: Final phase for late renewals.

- Dec 2025: Gold Cards fully retired.